In this article, I’ll explain the simple steps on how to claim staking rewards from different platforms.

Whether your rewards are distributed automatically or require manual claiming, understanding the process helps maximize returns.

By following the right methods, you can efficiently manage rewards, avoid unnecessary fees, and grow your crypto portfolio through smart staking practices.

What Are Staking Rewards?

Staking rewards represent compensation accrued through the voluntary immobilization of cryptocurrency within a proof-of-stake (PoS) blockchain or a delegated staking service.

By committing a participant’s tokens to a stake, they reinforce the protocol’s security and facilitate consensus, thereby supporting the ongoing functionality of the distributed ledger.

In compensation, the protocol allocates rewards, customarily denominated in the same asset that was originally committed.

The yield is contingent upon variables that include the stake quantity, the reliability and performance metrics of the selected validator, and the underlying reward formula defined by the protocol, positioning staking as a viable mechanism for passive asset accumulation.

How To Claim Staking Rewards

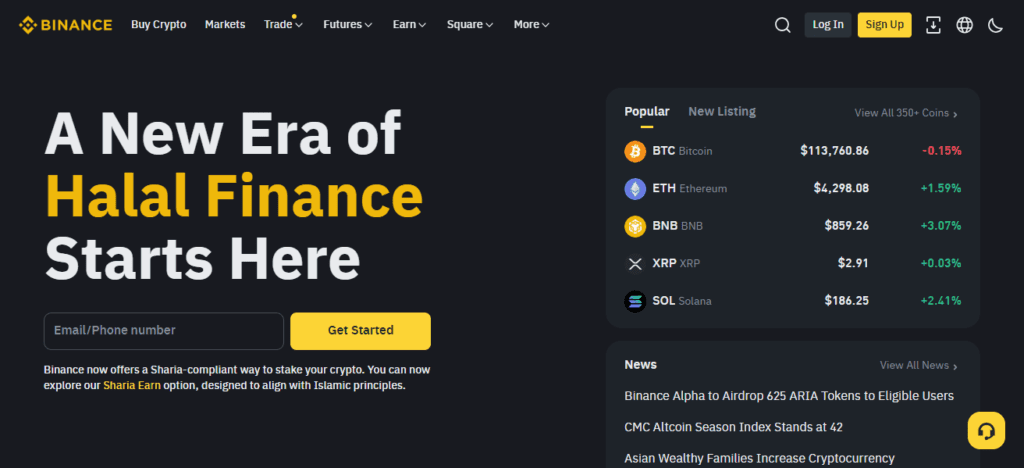

On Binance, claiming staking rewards is a largely automated process, as rewards are credited directly to your Spot Wallet. Follow these steps to verify and, if desired, reinvest your accrued rewards:

Access your Binance account via the web interface or mobile application.

Navigate to the “Earn” section and select either “Simple Earn” or the dedicated staking interface.

Identify the cryptocurrency you previously staked (for instance, Ethereum, Cardano, or Solana).

Examine the “Rewards History” tab to review the staking rewards already credited.

Rewards for a majority of supported tokens are automatically deposited in your Spot Wallet on a daily or weekly cycle; therefore, no manual claiming is necessary.

To reinvest the rewards, either re-subscribe to the staking product or enable the “Auto-Subscribe” function, which automatically compounds accrued rewards on the next staking cycle.

Different Ways Staking Rewards Are Distributed

Staking platforms and blockchains vary in their mechanisms for distributing rewards, each method influencing user experience and return calculation.

1. Automatic Distribution

- Rewards are issued straight to the user wallet after predetermined intervals—commonly daily, weekly, or with the closing of an epoch.

- This method is frequently found on centralized exchanges, including Binance, Coinbase, and Kraken.

- No user action is necessary; the accrued rewards quietly add to the account balance.

2. Manual Claiming

- Users are required to log in and actively claim rewards via the staking dashboard or wallet interface.

- Each claim is a transaction on the underlying network, which may incur gas fees and alter the net reward.

- This mode is prevalent in non-custodial wallets—such as MetaMask, Trust Wallet, Keplr, and hardware devices like Ledger—as well as in DeFi staking pools.

3. Auto-Compounding (Re-Staking)

- By default, accrued rewards are automatically added to the already-staked amount, enlarging the principal and accelerating growth without the maintenance overhead of manual intervention.

- This process yields implicit compound interest and avoids the loss of yield exposure during the claim-re-stake cycle.

- Certain platforms provide a toggled auto-compound feature, while others offer dedicated staking pools engineered for compounding.

4. Epoch-Based Distribution

- Within particular Proofof-Stake blockchains—specifically Cardano, Polkadot, and Cosmos—rewards are allocated only upon completion of a fixed-duration epoch, which adds rhythm to reward visibility and withdrawal.* Some networks push rewards directly to the wallet, while others require manual claiming at the end of each epoch; consult the specific protocol documentation for clarity.

Things to Keep in Mind Before Claiming

- Gas fees (Ethereum vs. low-fee chains).

- Claim frequency – Claiming too often may waste fees.

- Tax implications – Rewards may be taxable income in some countries.

- Security tips – Always use official apps/sites.

Best Practices to Maximize Rewards

Use auto-compound features if available

Let the protocol automatically re-stake earned rewards to accelerate compounding while saving time.

Claim during low gas fee times

Execute transactions when network congestion is minimal to conserve a larger share of rewards.

Choose reliable validators/platforms

Opt for well-vetted validators or platforms to reduce the risks associated with slashing or service downtime.

Reinvest or diversify staking for long-term growth

Distributing or compounding rewards across various assets enhances compounding advantages while moderating concentrated risk.

Troubleshooting Common Issues

Rewards not showing up – This condition typically arises when rewards are in a pending state, the validator is underperforming, or distribution adheres to an epoch-based schedule.

Claim transaction failed – In general, failures result from inadequate gas fees, heightened network congestion, or wallet software requiring an update to a newer version.

Locked/unbonding periods preventing withdrawal – Certain blockchains impose mandatory lock or unbonding intervals, effectively barring the immediate withdrawal of rewards or staked tokens.

Conclusion

In closing, obtaining staking rewards remains a largely uncomplicated procedure, albeit with differences dependent on the hosting platform.

Certain providers credit rewards to the user’s wallet without further action, whereas others necessitate a manual claim that incurs a gas fee.

Familiarising oneself with the specific mechanics of the chosen service, identifying the optimal moment to claim, and leveraging functionalities such as automatic compounding can considerably enhance yield.

When administered judiciously, staking rewards represent a dependable mechanism for the incremental appreciation of digital asset portfolios over the long term.

FAQ

Yes, manual claims usually require gas fees.

Some platforms offer auto-compound to maximize returns.

They may be pending, validator underperformed, or distribution is epoch-based.